Momentum for ambitious CO2 targets

The energy service provider ista is diversifying its financing structure. As part of this, the company is, for the first time, issuing an ESG-linked Schuldschein in the amount of some 450 million euros.

The same rule applies again in this round of financing : it is linked to the company’s ambitious sustainability targets. The Schuldschein was concluded with international and local investors.

ista concludes second ESG-linked financing of some 450 million euros

“As a partner of the real estate industry, we support our customers on the road to a sustainable future. ista itself has the target of being CO2-free, i.e. net zero, by 2030. To achieve this, we are taking concrete steps and can then be measured by their success. The financing is a clear commitment to this strategy,” says Thomas Lemper, CFO of ista. “We are delighted that a further group of international and local investors has confidence in our long-term sustainability strategy and is supporting us on the road to a CO2-free future.”

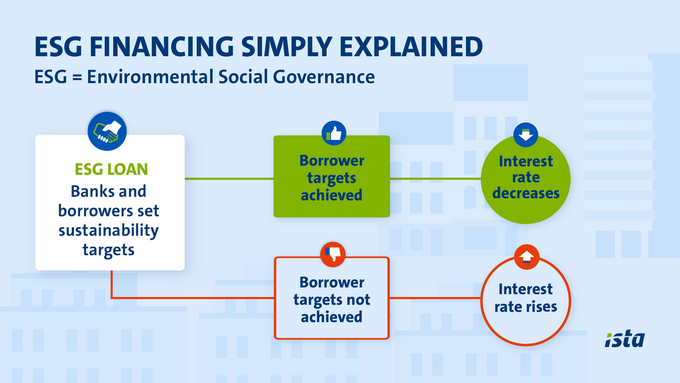

The new ESG-linked Schuldschein was arranged by Landesbank Baden-Württemberg, Raiffeisen Bank International and UniCredit and has a term of 5 years. With the Schuldschein, the company is diversifying its loan portfolio on the one hand and can reduce its long-term financing costs on the other. As is standard with ESG-linked funding (ESG = Environmental, Social and Governance), the interest rates are linked to the fulfilment of sustainability targets. In the case of ista, these will include CO2 emissions per employee and the further expansion of the digital service infrastructure, which should be as resource-efficient as possible. If ista achieves the agreed sustainability targets, it can reduce the credit margin ; conversely, the margin increases if the targets are not met. The sustainability KPIs will be audited by SGS-TÜV Saar GmbH.

The new ESG-linked Schuldschein will be partly used to refinance the current syndicated loan. Overall, ista’s financing strategy is geared to supporting the company’s long-term growth strategy. “The digitalisation of the real estate industry is creating potential for climate protection in buildings,” says CFO Lemper. “Thanks to this new financing we can invest still further in developing digital products and services. For example, within a very short space of time, we have developed and launched a completely new product for commercial customers’ energy controlling requirements. It enables customers to achieve energy and CO2 savings of up to 15 per cent.” ista is also currently working on smart monthly consumption information for residents. This solution allows each user to decide individually whether they would like to receive the information on their heating energy consumption via the Web, an app or e-mail. A dena study shows : people who are regularly notified about their consumption can go on to achieve energy and CO2 savings of some ten per cent. The prerequisite for this is a good radio infrastructure. That is why ista will, in the next five years, be investing 600 million euros in the expansion of this infrastructure and the roll-out of 10 million smart metering devices.

More information : https://www.ista.com/corporate/newsroom/momentum-for-ambitious-co2-targets-ista-concludes-second-esg-linked-financing-of-some-450-million-euros/