CBI releases Green Bond Treasurer Survey report

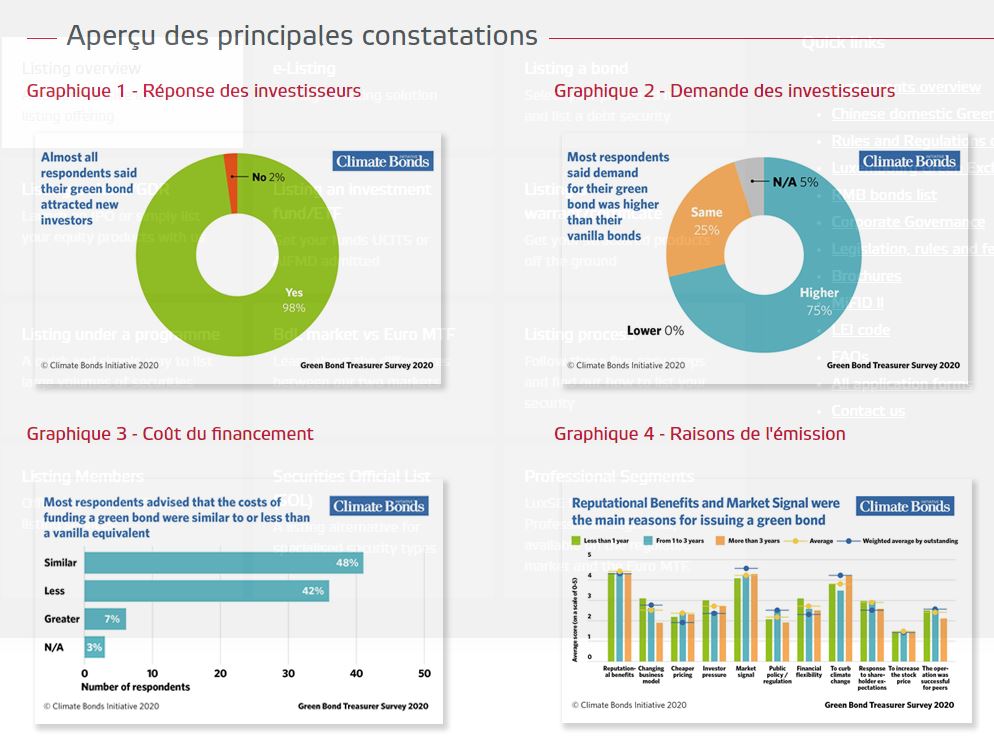

The survey suggests that issuers identify multiple benefits from green bonds, with visibility, a larger investment base, stakeholder engagement and catalysing new business highlighted as the main factors.

A broader investor base, enhanced visibility, strengthened stakeholder relationships and catalysing new business lines are amongst the benefits of green bond issuance according to a global Green Bond Treasurer Survey carried by Climate Bonds Initiative.

Sponsored by Danske Bank and the Luxembourg Stock Exchange’s LGX with supporting analysis from Henley Business School from the University of Reading, the Green Bond Treasurer Survey 2020 is a first of its kind, unique interrogation of market experience to identify core benefits and challenges of issuing green bonds and provides guidance to potential newcomers into green financial markets.

Eighty-six treasurers from thirty-four countries were interviewed. Respondent organisations represented around 44% of the identified green bond universe accounting for a total of USD7.4tn in bonds outstanding, including USD222bn of green bonds and which collectively had issued six hundred & eighty-six (686) green bonds at the time of data collection.

The questionnaire explored the end-to-end process of issuing a green bond and solicited views on integrating sustainability and the potential to enhance growth and scale of the market.

“The survey clearly reflects the respondents’ desire to reap the benefits of the green bond market and shows that the additional visibility, credibility and liquidity linked to the listing of a green bond on an exchange are highly appreciated by treasurers. In the current context, we see an increase in social bonds in response to the COVID-19 pandemic and we expect more and more organisations to broaden their scope of thematic bonds in the coming months,” commented Julie Becker, Deputy CEO of LuxSE and the Founder of LGX.