The role of finance in well-being oriented and sustainable societies

Financial activities have been initially invented to satisfy a need : matching the supply of savings with the demand for investments. Finance’s mission became generating profits for the sake of profits, thus contributing to current development unsustainability.

Will finance and banking manage to re-orient their activities to promote well-being in socially and environmentally sustainable societies ?

The excessive emphasis on money - typical of modern societies - creates a perverse incentive to grow and accumulate private fortunes without considering their purpose. The 2008 financial crisis is a lingering memory of the social disasters that can arise from this approach. A relatively small speculative bubble made possible by poor regulations, opaque financial instruments, and attempts to sustain consumption in one of the world’s most affluent societies had far-reaching consequences, impacting the lives of billions of people worldwide.

In the early 2000s, the loss of economic competitiveness and the increased income inequality threatened Americans’ purchasing power. However, rather than reducing consumption, the financial and banking system backed Americans’ lifestyle offering easy credit in exchange for large gains. This system generated great fortunes until a relatively minor default revealed its fragility triggering the well-known credit crunch and its dramatic consequences on real economy.

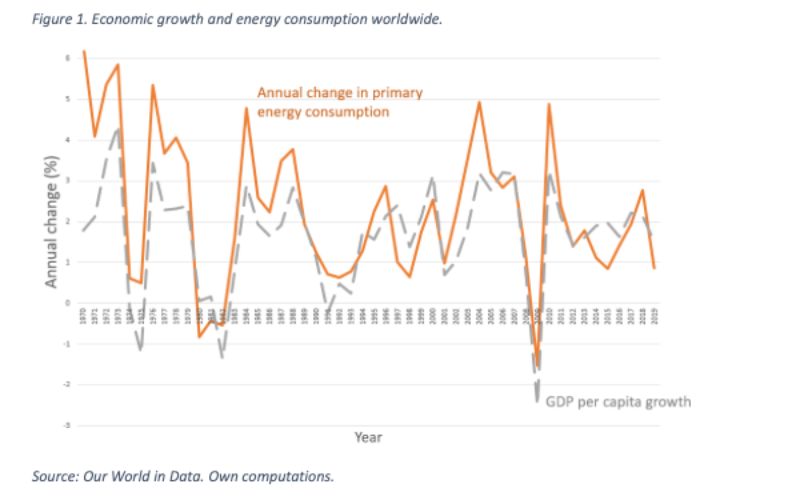

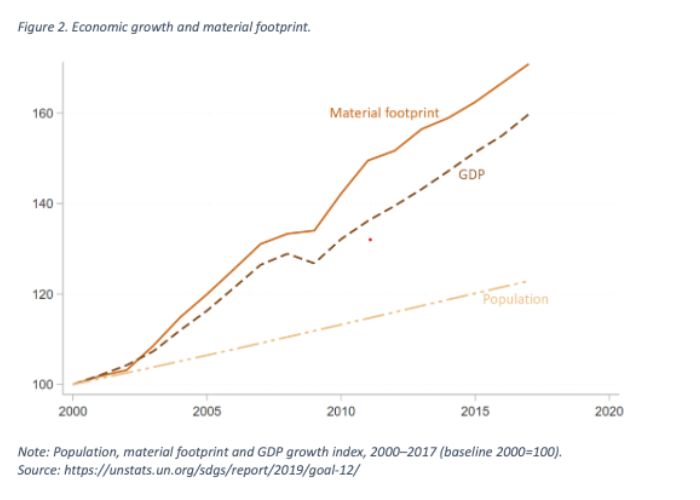

The preeminence of money and its accumulation undermine the environment too. Figures 1 and 2 demonstrate the association between economic growth, CO2 emissions - the main driver of climate change - and material footprint, a measure of resource consumption. Both figures indicate that economic growth is historically coupled to negative environmental externalities. That is efficiency gains and green technologies are not sufficient to mitigate the detrimental effects of economic growth on the environment. CO2 emissions temporarily decreased only during recessions (in figure 1, CO2 emissions decline markedly when GDP per capita growth is negative). Is living in a perpetual crisis the only way to protect the environment ? The answer is clearly negative, but for this to happen the societal goal should shift from the production of goods and services to the provision of well-being. The success of a society should be measured by its ability to transform resources into quality of life.

Can the banking and finance industry rediscover its original mission and contribute to well-being in socially and environmentally sustainable societies ? A world oriented towards well-being will still require financial and banking services, but their goal should shift from the production of money for the sake of money to the production of money for the sake of well-being. As money primarily equates well-being for those at the lower end of the income distribution, the output of banking and finance should be aimed at initiatives to durably improve well-being, such as financing public goods and services — including high quality and free education, healthcare, public transport —, reducing income inequality, lowering the retirement age, or supporting universal basic income.

In conclusion, the banking and finance industry must realign its purpose with the original mission of facilitating resource allocation and contribute to societal well-being. This requires shifting from a profit-driven approach to one that prioritizes well-being, particularly for those with lower incomes. It’s time for a paradigm shift from the pursuit of wealth to the provision of well-being as a measure of progress.

Francesco Sarracino

Extrait du dossier du mois « L’âme de fonds »