ESG rating linked to outperformance during pandemic, says Fidelity

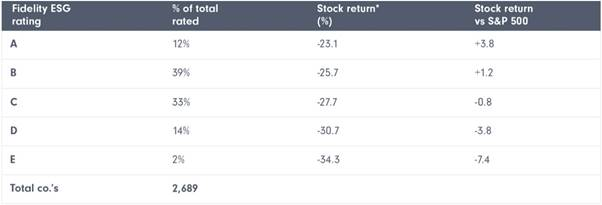

The recent period of market volatility as a result of the coronavirus pandemic has shocked in its severity. But the broad-based sell-off did discriminate, as new data from Fidelity International reveals. Each additional level (from A - E) of Fidelity’s proprietary environmental, social and governance (ESG) ratings was worth 2.8 percentage points of stock performance versus the index during recent volatility, according to the research*.

- A company’s market performance and ESG ratings are positively correlated

- Each ESG rating level was worth c.2.8% of stock performance versus the index during pandemic*

- Bonds of A-rated companies returned -9.23% on average, compared with -17.14% for C-rated companies**

Fidelity carried out a performance comparison across more than 2,600 companies, using its proprietary sustainability rating system***. The forward-looking ratings are derived from direct engagement with companies, aggregating approximately 15,000 individual company meetings per year.

The data found that a company’s market performance and ESG rating are positively correlated, even in a crisis. The equity and fixed income securities issued by companies at the top of Fidelity’s sustainability rating scale (A and B) on average outperformed those with average (C) and weaker ratings (D and E) in this short period, with a remarkably strong linear relationship.

In the 36 days between 19 Feb and 26 March, the S&P 500 fell 26.9 per cent. Meanwhile, the price of a share in companies with a high (A or B) Fidelity ESG rating dropped less than that on average, while those rated C to E fell more than the benchmark. A-rated companies performed on average 3.8 percentage points better, while E-rated companies performed on average 7.4 percentage points worse than the S&P 500 during the period examined.

Chart 1 : Attention to ESG earns market outperformance

Source : Fidelity International, April 2020

Jenn-Hui Tan, Global Head of Stewardship and Sustainable Investing, Fidelity International commented : “No asset was spared as the severity of the economic shutdown needed to contain the coronavirus outbreak became apparent to investors. The quickest US bear market in history, from February to March this year, was also the first broad-based market crash of the sustainable investing era.

“Our thesis, when starting the research, was that the companies with good sustainability characteristics have better management teams and so should outperform the market, even in a crisis. The data that came back supported this view.

“While some caveats remain, including adjustments for beta, credit quality and the sudden market recovery, we are encouraged by evidence of an overall relationship between strong sustainability factors and returns, lending further credence to the importance of analysing ESG factors as part of a fundamental research approach.”

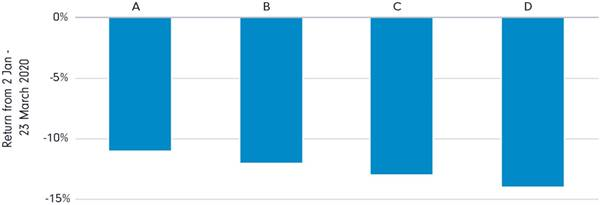

Bonds of A-rated companies outperform

The research from Fidelity International also found the fixed income securities of higher-rated ESG companies performed better than on average than their lower rated peers from the start of the year up to March 23, in an unadjusted basis.

The bonds of the 149 A-rated companies returned -9.23 per cent on average, compared with -13.16 percent for B-rated companies and -17.14 per cent for C rated companies.

Chart 2 : High quality ESG leads to better fixed income returns

Source : Fidelity International, April 2020

Jenn-Hui Tan added : “The recent period of market volatility was shocking in its severity. A natural behavioural reaction to market crises is to lower investing horizons and focus on short-term questions of corporate survival, pushing longer term concerns about environmental sustainability, stakeholder welfare and corporate governance to the background.

“But this short-termism would indeed be short-sighted. Our research suggests that, what initially looked like an indiscriminate selloff did in fact discriminate between companies based on their attention to ESG matters.

“It supports our view that a company’s focus on sustainability factors is fundamentally indicative of its board and management quality. This leads to more resilient businesses in downturns that will be better positioned to capture opportunities when economic activity resumes, more than earning its place at the heart of active portfolio management.”

Read more at fidelityinternational.com